FG Seeks Foreign Investments to Develop Transport Infrastructure

By Adaku Onyenucheya

10 October 2022 | 2:54 am

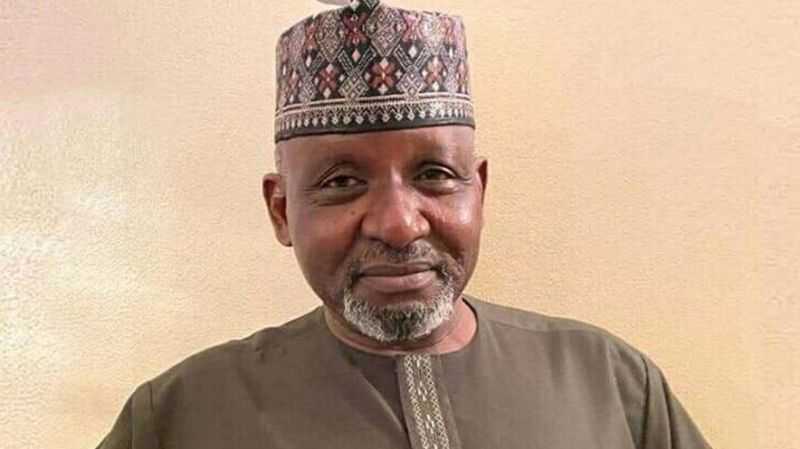

Minister of Transportation, Mu’azu Sambo

The Federal Government has said the transport sector’s projected five percent increase in the contribution to the national Gross Domestic Product (GDP) in the next five to 10 years may be stalled as the country cannot currently meet its transport needs, despite the exponential growth in the demand for transport services.

The Minister of Transportation, Mu’azu Sambo, who disclosed this at the Nigerian International Economic Partnership Forum held in New York, said poor maintenance and insufficient investments have put an enormous strain on transport infrastructure and services in the country.

He said as the government makes strives to ensure infrastructural projects are viable within a stable financial ecosystem, there are priority areas in the maritime, inland waterways, and rail subsectors of the transportation sector.

Sambo, who delivered a paper on ‘Financing Nigeria’s Transport Infrastructure,’ said the maritime subsector, which hosts six major seaports engaged in international maritime trade, namely Tincan, Apapa, Calabar, Onne Port, Portharcourt, and Warri, had suffered infrastructure decay since their various dates of operation.

He said the seaports have suffered dilapidation and decay over the years and now require massive capital investments for upgrades and rehabilitation.

The minister said there is a need for urgent investment in Apapa and Tincan Island ports, which account for about 70 percent of the nation’s maritime trade, as well as Calabar and Warri ports, which present investment opportunities in dredging, to maintain regular draught of about 7.5metres.

He also emphasised the need for deep seaports to attract the biggest shipping vessels to the country, which has necessitated the desire to create deep sea ports with an average draught of 15 metres.

Sambo called for investment in the Ibom deep sea port in Akwa Ibom, which is in the fifth stage of development, as well as the Badagry deep sea port that has recently been approved by the Federal Executive Council (FEC) for construction by international private investors for 45 years Build, Own, Operate and Transfer (BOOT) basis.

He said other ongoing initiatives for deep seas ports include Bonny and Bakassi, which present themselves as opportunities for private capital.

Sambo also called for private capital investments in inland dry ports and rail networks targeted at manufacturing, agriculture, and solid minerals to decongest seaports, improve supply chain logistics and bring shipping activities closer to shippers in the hinterland.

Speaking on the inland waterways subsector, the minister said: “While the Onitsha port has already been concessioned to private investors, other opportunities in this subsector include the concession of Oguta, Baro, and Lokoja ports; operation of the ferry (passenger) and freight (cargo) services along the inland waterways corridor; development of additional river ports and jetties along other inland waterways navigable routes on PPP arrangements and the development of tank farms along the inland waterway corridors to leverage the waterways for the carriage of petroleum and other bulk liquid cargoes to the hinterland.”

Sambo also noted that key areas in the transport sector that need immediate attention include, the completion of rehabilitation of all narrow-gauge rail lines and the construction of standard gauge rail lines for the carriage of goods and passengers in line with the 25 – year Railway Master Plan.

Others, he said, are Public-Private Partnerships for the development of Vehicle Transit Areas (VTAs) to facilitate both local and international trade, as well as effective and sustainable channel management, security, and safety for ports and inland waterways.

Sambo also added the implementation of the ECOWAS protocol on Trade Facilitation and the Africa Continental Free Trade Area Agreement (AfCFTA), while promising a return on investment as well as a guaranteed and secure environment for investors.

Speaking on transport infrastructure financing strategies, the minister said, “Infrastructure is vital for the long-term growth and competitiveness of countries worldwide. It is however capital intensive as various national governments are facing constraints in developing and funding infrastructure projects. Likewise, the Nigerian government is increasingly exploring alternative sources of finance for infrastructure development.

“Public Private Partnerships have proven a viable option to unleash unprecedented infrastructure growth and create a balance between state ownership and privatisation,” he said.

Credit: THE GUARDIAN NIGERIA NEWS